CPO & Partners at the ICG European & Asia Integration Meeting – Madrid, 8 July 2025

CPO & Partners at the ICG European & Asia Integration Meeting | Madrid, 8 July 2025

A day dedicated to international cooperation and strategic dialogue across continents.

The 2nd European & Asia Integration Meeting, hosted by the International Consulting Group in Madrid, brought together professionals from Europe, Asia and Latin America to reflect on today’s global challenges and explore joint solutions in legal, tax and business consultancy.

CPO & Partners contributed with updates on current initiatives in China, including business missions, industrial park partnerships and cross-border investment strategies—demonstrating once again the relevance of building strong, practical bridges between distant markets.

Grateful to ICG and all participants for the enriching discussions and shared vision. Looking forward to future collaborations.

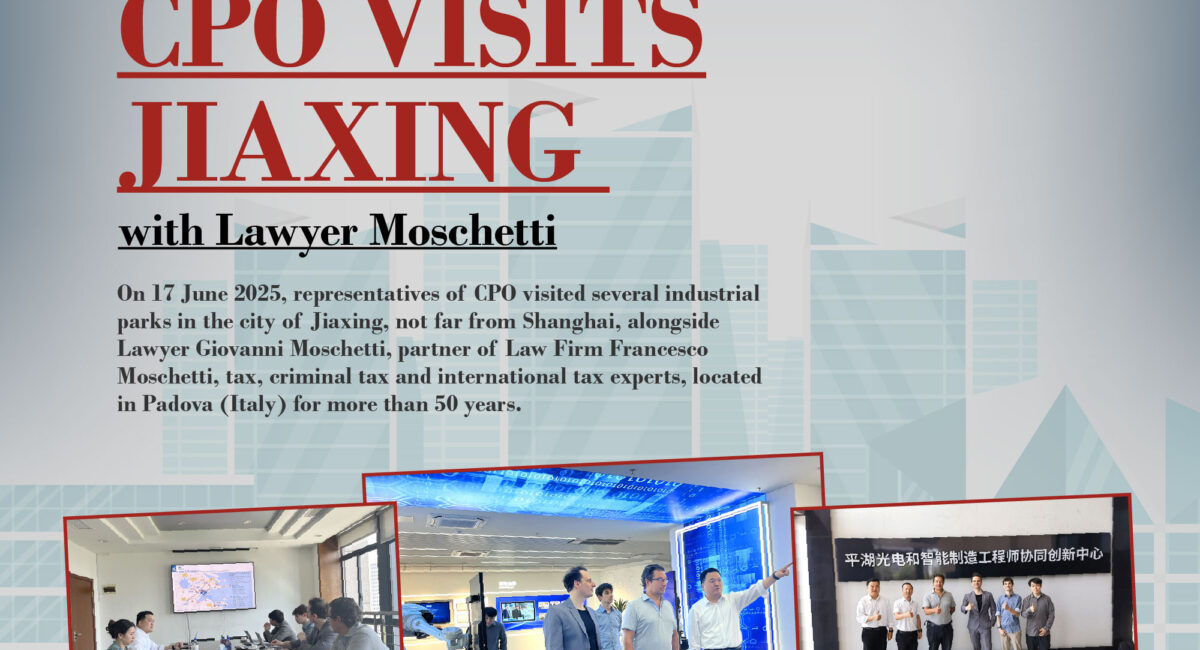

CPO Visits Jiaxing with Lawyer Moschetti

CPO Visits Jiaxing with Lawyer Moschetti

On 17 June 2025, representatives of CPO visited several industrial parks in the city of Jiaxing, not far from Shanghai, alongside Lawyer Giovanni Moschetti, partner of Law Firm Francesco Moschetti, tax, criminal tax and international tax experts, located in Padova (Italy) for more than 50 years.

The day began with a visit to the Pinghu Economic and Technological Development Zone, an industrial park located in the county-level city of Pinghu, part of Jiaxing City in China’s Zhejiang Province. In the afternoon, the delegation moved to Nanhu District, where it held meetings with local government officials from Nanhu District. Discussions focused on cultural exchanges between Italy and China and the incentives the parks can offer to Italian entrepreneurs interested in investing in China.

The presence of Lawyer Moschetti, a professional with over 20 years of experience in tax and legal fields, underscores the growing interest in better understanding China’s landscape and the potential opportunities, both cultural and economic, that can arise from such exchanges.

Future plans are already underway, including delegations of Italian entrepreneurs visiting the toured Parks and cooperation between the two countries to explore and leverage opportunities for economic and cultural exchange.

CPO at the Panda D’Oro Gala Awards – 2025 Edition

CPO at the Panda D’Oro Gala Awards – 2025 Edition

On June 14th, CPO & Partners had the pleasure to attend the XIV Edition of the Panda D’Oro Gala Dinner Awards, organized by the China-Italy Chamber of Commerce (CICC) in Shanghai.

The Gala represents one of the most prestigious events for the Italian business community in China, celebrating the outstanding contributions of companies promoting bilateral relations between Italy and China.

For CPO & Partners, this was a valuable opportunity to meet institutions and business leaders, share experiences, and reaffirm our ongoing commitment to supporting international growth strategies between Europe and the Far East.

We’re proud to continue fostering cooperation, building bridges, and promoting synergies that connect companies and territories.

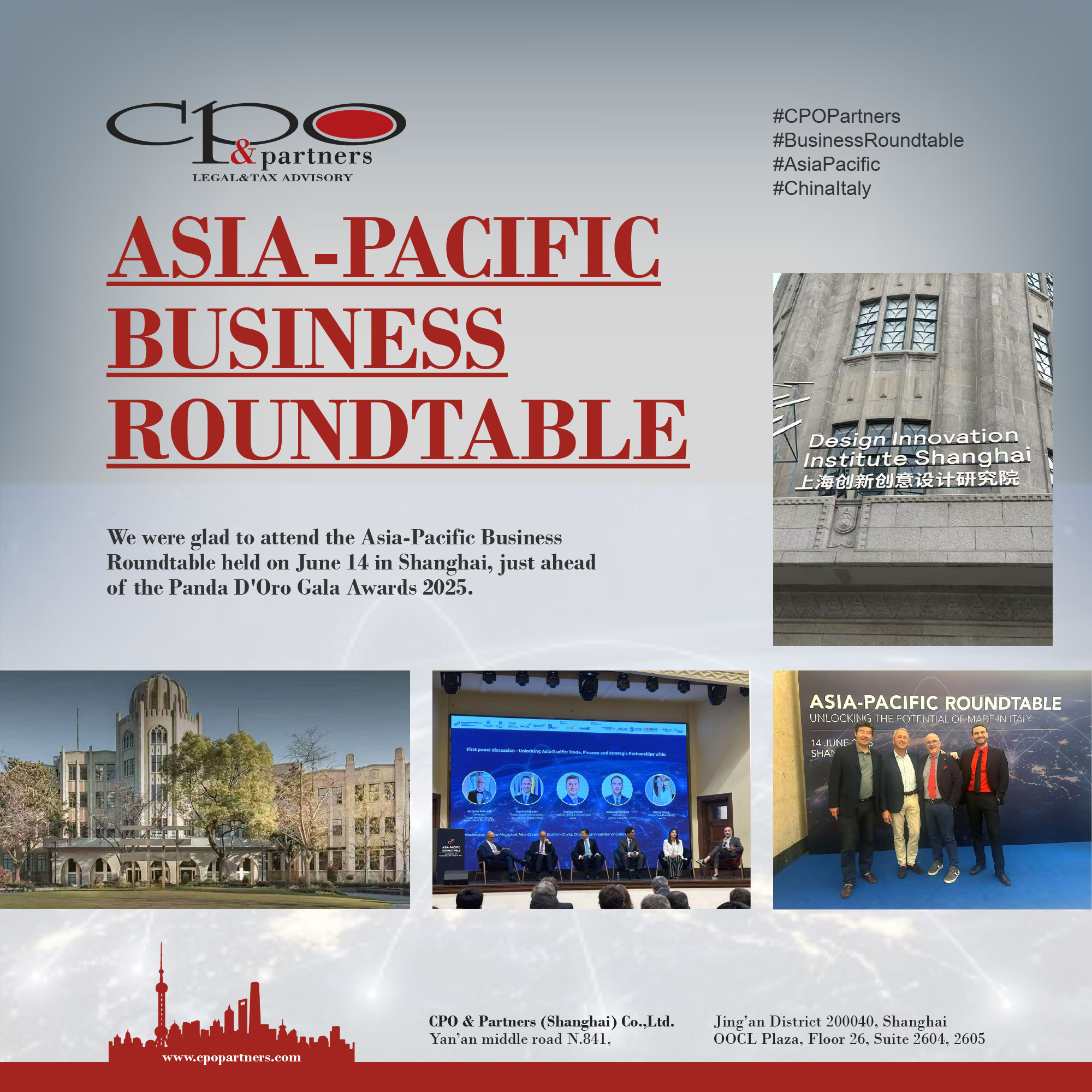

CPO & Partners at the Asia-Pacific Business Roundtable

CPO & Partners at the Asia-Pacific Business Roundtable

We were glad to attend the Asia-Pacific Business Roundtable held on June 14 in Shanghai, just ahead of the Panda D’Oro Gala Awards 2025.

An insightful opportunity to explore the current and future outlook of EU–China trade relations, and to connect with key players promoting Italian presence in the Asia-Pacific region.

A dynamic platform for dialogue, exchange, and future cooperation.

New legislation for China’s private sector economy

New legislation for China’s private sector economy

The Private Economy Promotion Law of the People’s Republic of China was adopted by the Standing Committee of the National People’s Congress on 30 April 2025, and took officially effect on 20 May.

The new law grants private enterprises equal legal standing and market opportunities alongside other ownership forms, such as State-Owned Enterprises (SOEs). The legislation acts in favor of fair competition practices for private firms, in terms of access to bidding, procurement etc. For example, Art. 10 provides for a nationwide unified negative list system for market access: private firms will be able to equally compete in any sector not included in the list.

Another important point is related to R&D schemes: private enterprises are encouraged to undertake major national science and technology projects, while entitled to receive from the state greater research infrastructure and data resources. The law also mandates government bodies and SOEs to honor payment obligations on schedule, with penalties for default.

Having faced for long-time discrimination and inequality of treatment compared to SOEs, private firms may find enhanced protection through the new legislation. However, as often occurs in the country, the actual safeguards offered by the law can only be evaluated against future enforcement mechanisms.

New tax rebate rates for exports from China

Last 15 November 2024, China’s Ministry of Finance and the State Taxation Administration released the Announcement No. 15 on the Adjustment of Export Tax Rebate Policies, effective from 1 December. It is set to impact the future business planning of local and foreign companies involved in export operations from China to foreign countries, especially in terms of higher costs and lower export volumes.

Two different sets of adjustments were introduced on China’s export tax rebate, incentive system started in 1985 through which refunds are given to exporters on VAT and consumption tax (CT) paid before the export of their products abroad. The first set provides for the cancellation of the tax rebate on 59 items, including copper and aluminium products (plates, sheets, bars etc.), chemically modified oils and fats, and other kinds of metals.

The second set includes a reduction of the VAT rebate rate from 13% (which entailed a full refund of VAT on purchases, being 13% in China) to 9% for 209 items. Refined oils, batteries, photovoltaic products are among the affected categories.

Seen since its inception as a strategic policy to improve the competitiveness of exported goods in the international market, the VAT Tax Rebate (出口退税) system allows exporters to recover VAT on goods intended for export, receiving the VAT paid on purchases (in full or in part, based on the specific VAT refund percentage defined for each customs code) directly into the company bank account, in a relatively short time (1-2 months) from the submission of the necessary documentation relating to export. The Tax Rebate system is applicable both to companies that carry out trading activities and to the manufacturing companies, with different application rules.

New Italy-China Double Taxation Agreement soon in force

New Italy-China Double Taxation Agreement soon in force

On 5 November 2024, the Italian Chamber of Deputies approved the bill for the ratification and execution of the Double Taxation Agreement (DTA) signed in 2019 between the governments of the Italian Republic and the People’s Republic of China regarding income taxes double taxation and the prevention of tax evasion and avoidance. With the Meloni government taking office in October 2022, the bill had to obtain a new approval by the Italian Council of Ministers, and subsequently underwent Parliament discussion. The Agreement will enter into force following the exchange of ratification instruments between the contracting countries, expected by 1 January 2025.

The 2019 Agreement updates the previous DTA signed on 31 October 1986, adapting the latter to the OECD/G20 BEPS Project.

Among the revisions, Article 10 provides for a reduced withholding tax rate from 10% to 5% in relation to dividends from investments participated for at least 25% of the capital, and continuously for 365 days.

Article 11 regulates interests, providing for a reduction to 8% for interests paid to financial institutions for 3 years minimum duration loans aimed at investment projects.

Finally, Article 12 confirms a standard rate at 10% for royalties, with a reduction to 5% for royalties on industrial, commercial or scientific equipment.

Stronger cooperation between China and Spain

Despite the ongoing conflicts over state subsidies and other trade-related issues between the European Union and the People’s Republic of China, in 2024 Beijing proved his willingness to foster and improve its trade relations with many European countries. Among them, Spain has been active in recent years towards strengthening the bilateral exchanges with China, as proved last month when Spanish Prime Minister Pedro Sánchez hold an official visit in the Asian country on 8-11 September.

As China’s fifth-largest trading partner within the EU, Spain has all the interest in promoting mutual openness in the trade environment between the two countries, with a total trade volume that in 2023 reached USD 48.58 billion. The economic ties were strengthened during recent years with a series of agreements, among which a Bilateral Investment Treaty (BIT) in force since 2008, a Double Tax Avoidance Agreement (DTA) in force since 2021, and a Social Insurance Agreement, effective since 2018 , this latter is an agreement that for example other European Nations, as Italy, do not have with China. One of the purposes of Sánchez’s visit was to reinforce mutual investments in a different variety of sectors: in this direction goes the deal, announced by the Spanish delegation and worth one billion dollars, signed with the Chinese Envision Group to build a new hydrogen equipment factory in Spain.

New opening up in China’s healthcare sector